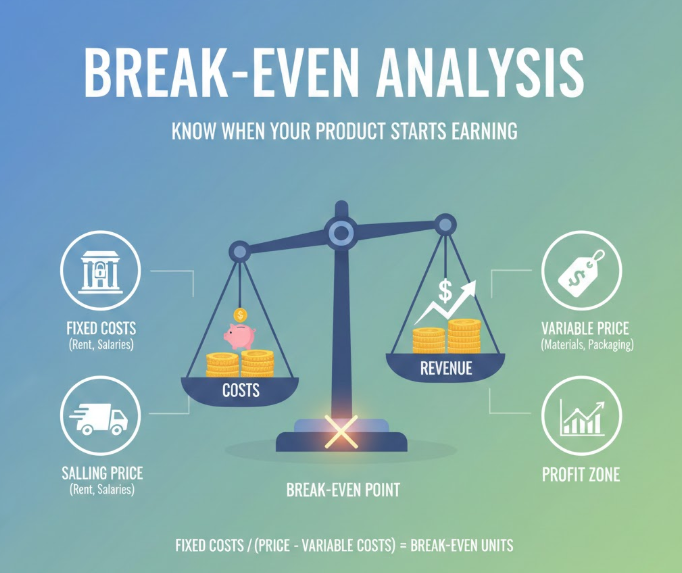

BREAK-EVEN ANALYSIS : KNOW WHEN YOUR PRODUCT STARTS EARNING

The "Zero-to-Profit" Formula A step-by-step roadmap to calculate how many units you must sell to cover all costs and start earning, helping you price smartly and avoid hidden losses.

If you are thinking of launching a new product , there’s a lot on your plate – from

planning, design and sourcing materials to settling prices and forecasting sales. But one

of the most crucial steps you shouldn’t skip is figuring out your break-even point.

Break even analysis help you answer a simple yet powerful question : ?how many units

do I need to sell before I start making profit ??

Understanding this is like having a financial compass – it gives you direction , helps you

manage risk, and enables better decision making .

s

Step-by-Step: How to Do It

Step 1: Lock Your Fixed Costs-

This category includes all perpetual expenses a business will incur regardless of the

business’s operational condition.

Think Rent, Computer Programs, Employee Salaries.

Example: Monthly fixed cost = rs.60,000.

Step 2: Identify Cost Per Unit-

For every additional unit of product sold, cost increases. This is the definition of cost per

unit.

Think: Delivery, Packaging, Raw materials.

Example: Variable cost per unit = 200.

Step 3: Guarded Pricing Strategy with Profitable Outcome-

Positioning and profit goals strategy introduces the risk of misleading price

transparency. Avoid copying competitors salting wounds further deep into analytics.

Example: Selling price = 500 rs per unit.

Step 4: Ease In to It-

Break-even point in units is equals to fixed costs divided by selling price minus variable

cost.

W = 60,000 / 500 – 200 = 200 units.

200 sales will need to be made in order to recovers costs.

Step 5: Remember Loss Margin-

Profits and festive sales ran promotions reduce income per unit quantify received

income resulting in real income loss per unit.

Example: New price with discount = 450 rs after 10% discount

New BEP = 60,000 / (450 - 200) = 240 units

Takeaway: Discounts make your break-even higher. Be strategic.

Step 6: Run “What-If” Scenarios-

What if the materials needed skyrocketed? What if you lowered your prices to build

more market share? Adjusting specific costs or selling prices can help avoid

unwarranted surprises. There’s no harm in testing.

Mistakes to Avoid (That Could Cost You Big):-

Ignoring hidden costs – Spend every single rupee including, but not limited to,

marketing, payments, taxes, and even payment fee packets.

Overhyping sales forecasts – You need to be realistic. Break-even is built on actuals,

not vision.

Using gross price instead of net: Never ever forget the commissions or fees your

platform will take from you.

Skipping discount calculations – When your selling price changes, your break-even

shifts and so does the reason why you calculated it in the first place.

Why It Matters (Especially Today):-

In the chaos of today’s fast paced world, clear beats mess. Why clutter your mind when

you can have a clear one? With break-even analysis, you receive all the benefits listed:

when profits start rolling in, how to price, and the amount of sales you need to stay up

and running.

Every student startup or growing D2C brand needs to have this tool, as it provides a

serious competitive edge.

If you guessed your way to success, chances are you are not very successful.

Calculating them—instead—will help you utilize break-even analysis to maximize

profits. Run the numbers and adjust smartly.